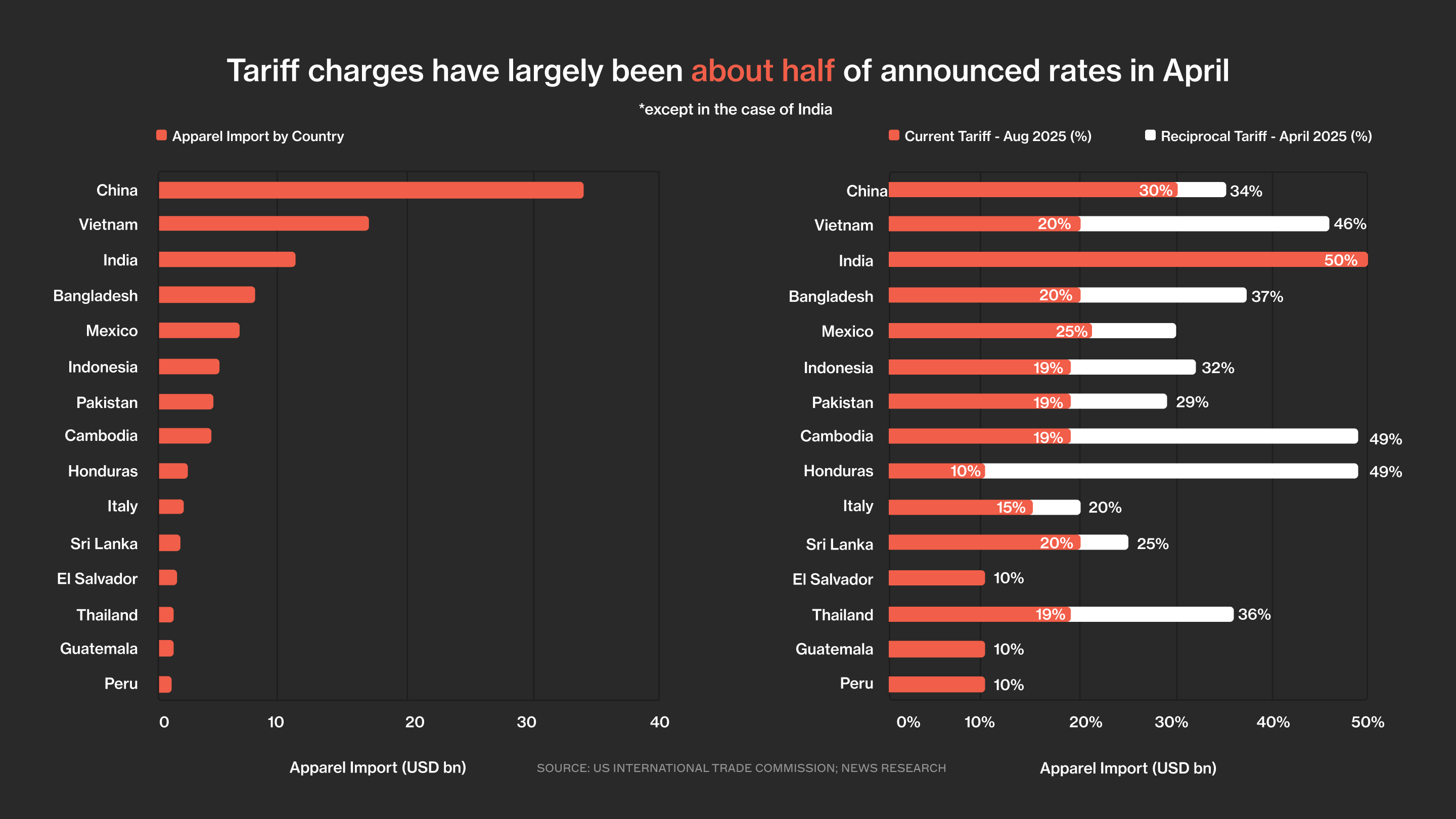

As of August 7, 2025, default tariffs have officially kicked in following a short-lived 90-day pause.

For fashion, this isn’t just a policy update—it’s a full-scale supply chain reshuffle. Countries that have long underpinned global manufacturing—China (30%+), Bangladesh (20%), India (50%), and Vietnam (20%)—are all facing elevated duties that add anywhere from $0.60 to $3.00 per garment, depending on category and FOB price (the ex-factory cost used to calculate tariffs). While tariffs are applied at this manufacturer cost stage, the increase cascades through freight, wholesale, and retail markups—so a $2 tariff at import can easily become $5–$7 more at the register.

Brands that had moved sourcing out of China in recent years are finding limited relief. Even diversified supply chains are now under stress.

This post continues our series on navigating the new tariff era—offering:

- Real-world strategies brands are deploying now.

- An invitation to join unspun’s Supply Chain Resilience Consortium, which aims to connect key players in building long-term supply chain agility.

What’s Happening: A Tariff Reality Check

Q2’s CPI stayed at 2.7%, but don’t get comfortable, the real price hikes are only just beginning. That’s because most duties only came into force this week. The real cost pressure—on brands, margins, and consumers—is coming fast.

Tariff Recap (Effective August 7, 2025):

(Rates subject to change—click here for tariff updates)

- EU: 15%

- Mexico: 25%

- Bangladesh: 20%

- Vietnam: 20% (excluding re-exports)

- China: 30% (subject to a different deadline, remains unresolved, and as of 12 Aug 2025, a 90 day extension has been granted)

- India: 50%

But here’s the real shocker: The actual implemented tariffs are only about 40–60% of what was originally announced in April.

At unspun, we’ve been closely tracking the evolving negotiations across the US’s largest apparel trade partners. Out of the 15 most significant import sources, with the exception of China and India (which together accounted for over a quarter of US apparel imports in 2024), every other country has seen its effective tariff rate come down from the high 40s to below 20%.

Feels like a win? It's not. Not even close. That 20% is still hitting like a freight train.

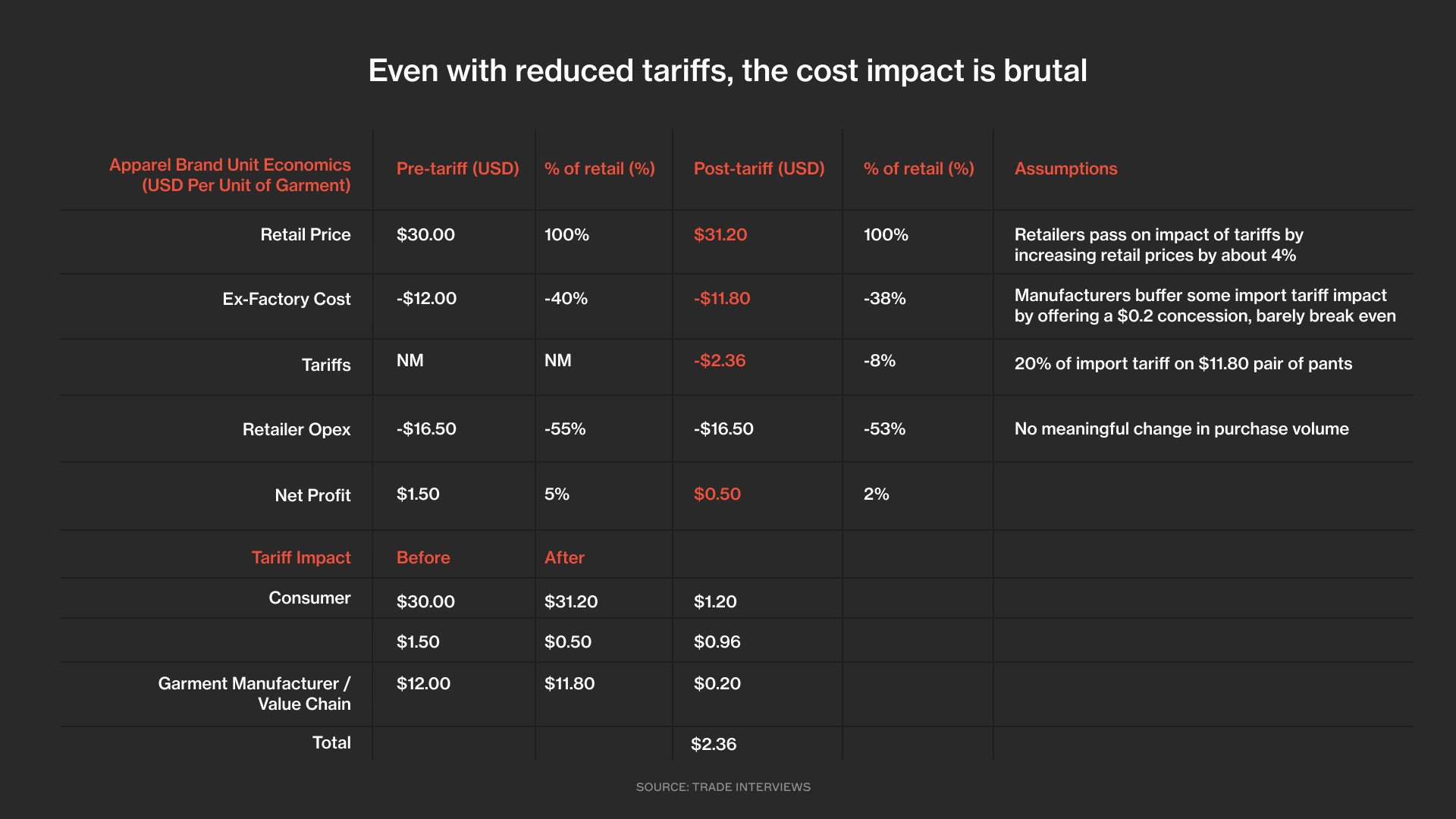

Tough Outlook for Retailers and Manufacturers

Using Bangladesh pants imports as a baseline, the new tariff structure still adds $2.36 in import fees on a $12 ex-factory pair of pants. Based on pricing data from Sourcing Journal and Dataweave, we’ve updated our assumptions:

- Retailers are raising prices—apparel prices are already up 2% and expected to rise another 2%

- Consumers will shoulder ~$1.20 in higher retail prices

- Retailers will eat ~$0.96 per unit, reducing their net margin from $1.50 to just $0.50—a 66% collapse

- Manufacturers will absorb ~$0.20, eroding already razor-thin margins

Manufacturing margins? Nearly wiped out. Retailer profits? In freefall.

Some companies are still hedging, but forward-looking players are already in motion.

How Savvy Brands Are Taking Action

1. Doubling Down on Flexible Manufacturers

Production partners that can pivot across geographies without blinking? Gold. Flexibility is now a sourcing KPI.

2. Leveraging Re-Export Hubs (while they can)

To skirt origin-based duties, some brands are routing production through re-export centers—particularly in Indonesia and the UAE. This legal gray zone is gaining traction fast.

3. Pushing Costs Upstream

Brands are negotiating aggressively with suppliers to absorb duties. It’s a short-term fix, but one that’s already testing the limits of supplier resilience.

4. Sneaking In Price Hikes

Where they can, brands are rolling out small, phased price increases to maintain margin without shocking consumers or losing share.

5. Reinvesting in Near-Shoring and On-Shoring

Forget the PR spin. The economics now back it up. Brands are building or reviving local production across the US and EU to cut costs, time, and risk.

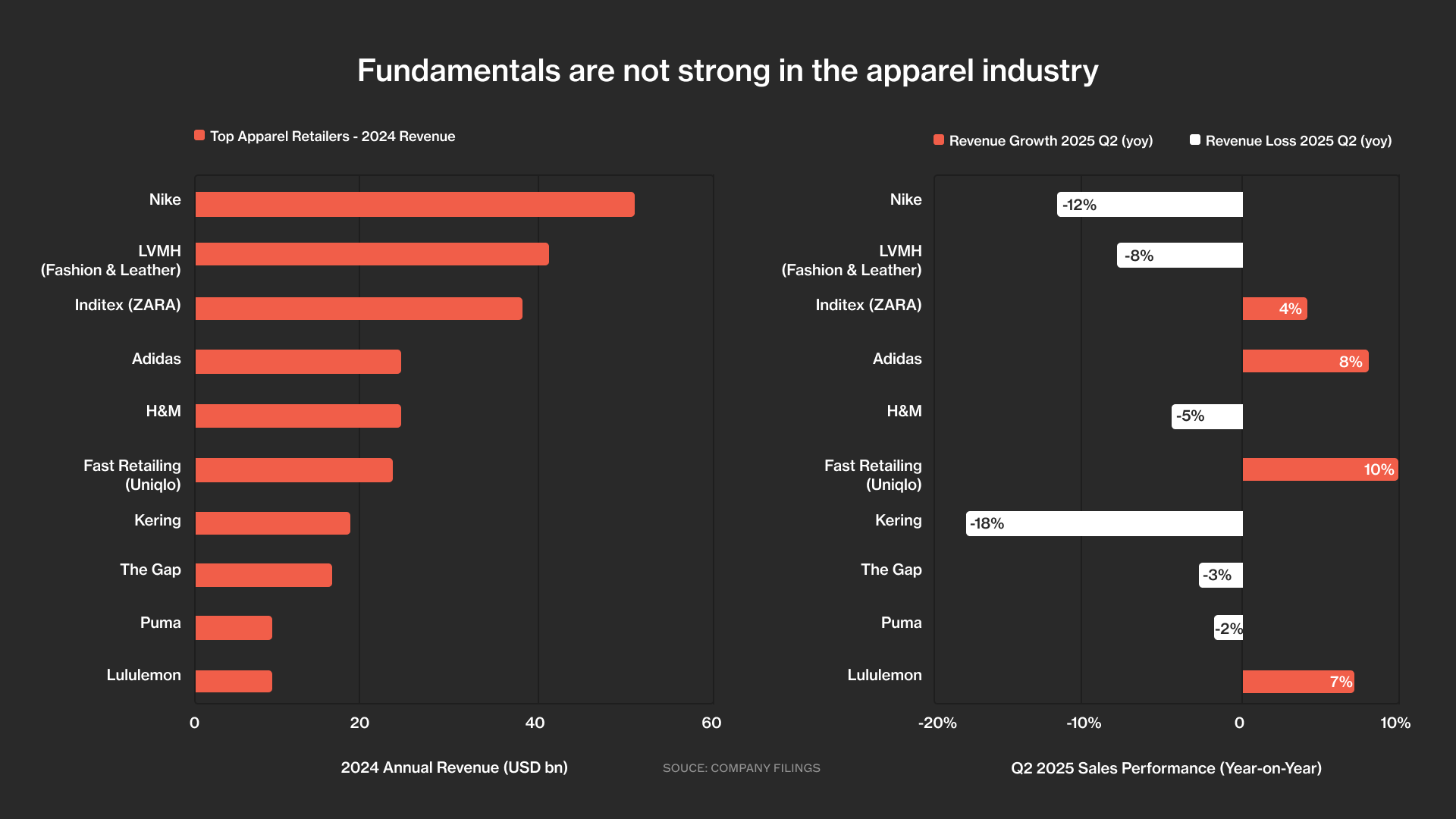

Even before tariffs, the apparel market was softening. Q2 2025 data shows negative revenue growth across most major apparel players—luxury, athletic, and high street alike.

With most goods only subject to 10% reciprocal tariffs through Q2, the full weight of tariff pain is still incoming.

The Cost of Waiting

For brands taking a “wait-and-see” approach, the risk isn’t just higher tariffs. It’s the compounding drag of inflexible supply chains, including:

- Inventory piling up

- Discount cycles kicking in

- Slow sell-through cycles

- Capital tied up in transit and warehousing

Tariffs are exposing the structural weakness of legacy operating models. Adaptability isn’t a bonus—it’s now existential.

There’s upside, too: companies leaning into localized production aren’t just avoiding tariffs—they’re also gaining consumer trust, building brand value, and creating faster, more responsive systems.

Relativity Is The Real Game

While the absolute tariff rates are painful, relative positioning is driving strategic shifts.

- Most of Asia—Vietnam, Bangladesh, Indonesia, Pakistan—is now in the 19–20% tariff band

- If countries like China or India manage to negotiate a drop to 15%, that’s $0.60 off per item which is enough to shift the balance.

- Latin America is rising: countries with 10% tariffs like Honduras, El Salvador, Guatemala, and Peru are attracting serious attention

Expect sourcing diversification—and fast.

Industry Consolidation Ahead

Closed-door conversations with brands and suppliers suggest we’re entering a consolidation phase:

- Retailers want to work with fewer, geographically flexible partners

- Financial pressure will force smaller manufacturers out, especially those unable to absorb tariff pain or shift production

This is survival of the most adaptable.

What Resilience Looks Like Now

Examples from around the world show what’s working:

- ON LightSpray™: An automated microfactory in Zurich that manufactures all performance running shoe uppers directly in Switzerland using fully automated, industrially scalable processes.

- Decathlon: Investing in modular manufacturing hubs across Europe for decentralized and near-shored production

- Boss: Leaning into Made-in-Germany production to gain full control and speed-to-market

At unspun, we’re helping shape this shift.

Onshoring Your Supply Chain: How unspun Can Help

Built for Speed: unspun’s Solution for Faster Woven Production

To stay competitive—especially with localization and nearshoring on the rise—brands need speed, agility, and automation built into their supply chains.

In July, we made the fastest pants in the world, under one roof. Using our Vega 3D weaving platform, we went from yarn to finished garment in just 20 minutes.

We built Vega to unlock localized manufacturing at scale. It’s not a prototype—it’s proven. We’re ready to scale to 1M+ units in the next 12 months.

From our pilot facility in California to upcoming full-scale rollouts in the US and Europe, Vega replaces weeks-long lead times with real-time production.

Our time studies show that pants made with Vega can be assembled in half the time it would take a standard production process for the same design, and x6-10 times faster when compared with 3D knitting.

That time advantage will grow as the system evolves. The result? Brands that work with us can shift geographies, adapt fast, and cut time-to-market—without compromising on quality or cost.

Join the Supply Chain Resilience Consortium

We believe no brand should face today’s tariff shocks or tomorrow’s policy shifts alone.

That’s why we’re launching the Supply Chain Resilience Consortium this September—an industry initiative to build shared infrastructure for automated, regional production.

The consortium brings together forward-thinking brands and manufacturing partners around a common goal: to accelerate flexible manufacturing and deploy real-time software that makes global supply chains more responsive and resilient.

We’ve already committed a significant portion of funding to help onboard brands and manufacturing partners into this new production model—and we’re backed by years of policy research and regulatory engagement in both the US and EU.

Together, we can:

- Build and share regional manufacturing infrastructure

- Reduce dependence on long-haul, multi-month supply chains

- Adopt automated systems that cut costs and carbon

- Align with new policy frameworks in the US and Europe

This is an open call. If you’re a brand or manufacturer ready to be part of a new era in apparel production.

Come See for Yourself

📍 Want to get involved in the Consortium? Let us know

📆 Our Q4 EU Launch Event is the next chapter. A gathering for those committed to building an agile, post-tariff apparel industry. Sign up here to get on the list.

Let’s redraw the map—together.

.svg)